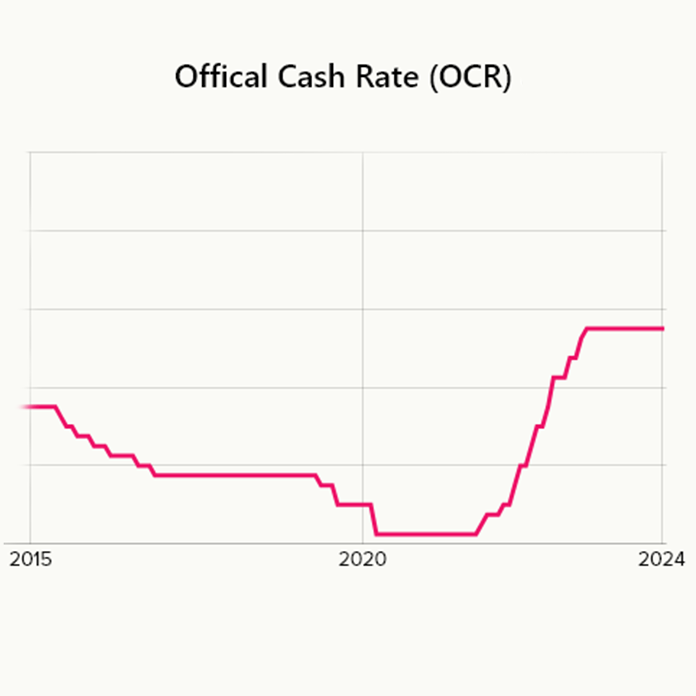

The New Zealand economy is beginning to see a glimmer of hope as inflation and interest rates ease. The Reserve Bank of New Zealand (RBNZ) recently cut the Official Cash Rate (OCR) by 25 basis points to 5.25%, marking the first reduction since March 2020. This move signals a shift in monetary policy, with further cuts anticipated towards 2025.

What This Means for Businesses

The OCR reduction is expected to ease financial pressures on businesses by lowering borrowing costs. This could lead to more affordable loans for Kiwi businesses, stimulating investment and consumer spending. Additionally, businesses might take this opportunity to refinance existing debts, enhancing cash flow and creating opportunities for reinvestment in growth. Although the economy remains under strain, particularly in terms of GDP per capita, easing interest rates are projected to act as a catalyst for recovery, benefiting businesses planning to expand, invest in new assets, or improve cash flow management.

Future Outlook and Considerations

Looking ahead, the RBNZ is likely to continue its easing cycle, potentially leading to a more favourable business environment. However, it’s important to remain cautious as global economic conditions, and the timing of similar rate cuts by the US Federal Reserve could influence the NZD exchange rate, impacting trade and international business operations. Businesses should also consider how lower interest rates might affect consumer demand, and borrowing strategies.

Key Takeaways

- The RBNZ’s OCR cut is a positive signal for businesses, potentially reducing the cost of borrowing.

- Further cuts are expected, offering more financial relief and opportunities for business growth.

- Businesses should stay informed and consider how these changes may affect their financial strategies, particularly in refinancing, expansion, and asset investment.

Moving Forward

As the economic outlook changes, it’s more important than ever for businesses to stay ahead of the curve. Understanding the potential impacts of OCR cuts and future monetary policies on your financial strategies can make all the difference. Whether you’re exploring refinancing, planning expansion, or seeking to optimise your cash flow, adapting to these shifts can set your business up for success.

To explore tailored solutions and gain expert guidance for your business needs, connect with your Crediflex broker today. We’re committed to helping you confidently navigate these shifts, providing the support you need to secure your business’s future.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog. This blog is for the use of persons in New Zealand only. Copyright in this blog is owned by Crediflex.