When Cyclone Gabrielle rained havoc in New Zealand from the 12th to the 14th of February this year most of us were unprepared. We heard the MetService warnings, and we made provisions for possible disruption. But the reality of that event proved to be far more destructive than most of us had perceived possible. Now as the skies clear and the sun begins its job of drying out the land, the cyclone’s hardest-hit victims are struggling to soak up its brightness.

They face the obvious challenge to clean up and replace damaged property, and the flow-on problems for businesses that can’t operate without supplies or customers. All this comes on the back of three hard years under Covid-19 restrictions. Many families and business owners have been left with unprecedented financial difficulties.

There is good news from the government which has set up a relief package with Special Relief Assistance Finance for flood victims. Within days of the event, they also announced a temporary exemption to some of the affordability requirements in the Credit Contracts and Consumer Finance Act. This assists Banks to speed up the finance application process for those who desperately need it. However, there are eligibility criteria to wade through. And when you’re struggling to get basics like water, power and communication up and running, or you’re up to your knees in soul-destroying silt, it’s hard to have the time, or concentration, to process the red tape.

Thankfully all banks have now released emergency financial support for their customers. This includes interest-free overdrafts, deferred or reduced loan repayments, waivered fees, and early access to term deposits without penalty.

Our entire Crediflex team extends sympathy and support to those impacted by the flooding. We have advisors in all affected areas helping individuals and businesses to get their lives back on track through financial planning. To us, flood victims feel like our family, and we are determined to go the extra mile for them. Our experts know the detail of the relief package and we’re working through our partnerships with lenders and banks to access funding for our clients, both business owners and individuals.

Small Businesses

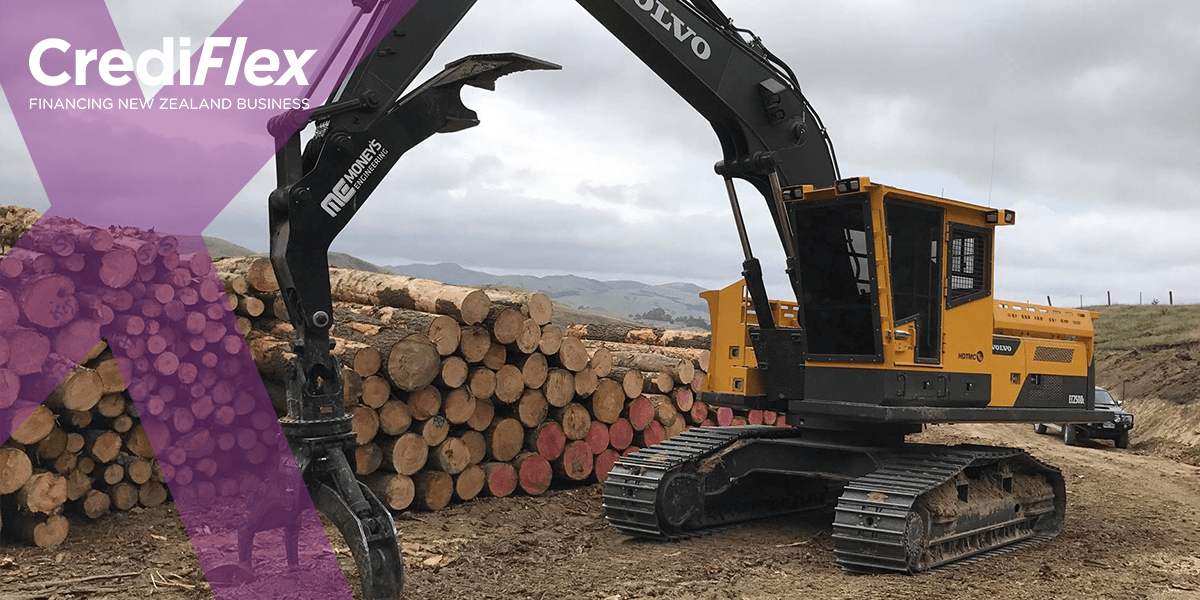

As a business owner, regardless of whether you employ staff, you are eligible for support when your business is facing significant cashflow issues due to continued challenges with customer access, ability to source stock, supply chain issues, inability to operate as usual due to the physical damage to equipment or premises, or delays in insurance assessment and repairs.

The grants of up to $10,000 are to help you keep operating and position you for a successful recovery, and to maintain your cash flow.

There is also additional funding of up to $40,000 for Farmers and Growers through the Ministry for Primary Industries

You could also be eligible for ….

- a temporary additional overdraft for up to 180 days or for interest-only business lending for up to six months.

- deferred payments on your business lending for up to six months.

- Early access to your Term Deposit or Notice Saver funds.

Individuals

The Government is making it easier for people who are in financial difficulty after sustaining damage from the floods, to get temporary credit. They’ve made a temporary exemption to the Credit Contracts and Consumer Finance Act (CCCFA) which allows banks and other lenders to quickly lend up to $10,000 to affected customers without the requirement for extensive assessments. The funds must be used to address damage, replace property, provide for loss of income, or meet their everyday living costs.

You may be able to…

- reduce the amount of your loan repayments

- a change to interest-only repayments

- defer loan repayments

- access your Term Deposit without penalty

- withdraw KiwiSaver funds

- reduce your credit card repayments

- change your credit card type

However, eligibility varies from person to person and situation to situation. This can make it difficult for already anxious flood victims to navigate the process. While the aftermath of the extreme weather events is guaranteed to cause stress for many New Zealanders, Crediflex advisors are committed to applying our expertise, and strong lender relationships, to help eligible people access the funding and support they need. We can discuss your specific situation and recommend a solution that is sustainable in the long term. While you work on the clean-up, we will secure your best finance option without charging you a fee.

The current flood relief package is only available for a limited period. There is however already talk of further initiatives and we are staying tuned to government announcements. Our expert team will be informed and able to respond quickly. If you would like to determine your eligibility and find out how you can access the funding, call us now for a no-obligation chat.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog.

This blog is for the use of persons in New Zealand only.

Copyright in this blog is owned by Crediflex You must not reproduce or distribute content from this blog or any part of it without prior permission.