In the world of finance, we often hear about the importance of securing low interest rates. And while it’s true that lower rates can save you money in the long run, there’s a critical aspect that often takes a back seat in these discussions – the structure of your financing.

Here at CrediFlex, we believe the way you structure your finances can significantly impact your financial stability, cash flow, and long-term goals. In this blog, we’ll explore why the structure of your finances can outweigh the interest rate.

1. Cash Flow is King

When it comes to running a successful business, cash flow is king. It’s the lifeblood of your operation, and having the right financing structure can make all the difference.

One key consideration is not to overextend yourself. We work with clients to ensure that their monthly commitments are manageable, allowing them to easily navigate both prosperous and turbulent times.

2. Align with Asset Life Cycle

Financing assets over their expected economic life is a strategic move. This approach reduces your monthly financial burden while ensuring your assets are fully paid off when it’s time for a replacement. It’s a win-win situation that optimises your financial planning.

3. Seasonality Matters

Many businesses experience seasonality or variable income patterns. Well-structured financing arrangements consider these fluctuations and tailor payments to match your cash flow.

Considering seasonality means you will be able to handle slow months and have the resources you need when business picks up.

4. Variable vs. Fixed Rates

Your risk tolerance and market conditions should play a significant role in your financing decisions. While fixed rates offer stability, variable rates may be more suitable during certain market conditions. We work with you to assess the best option for your specific circumstances.

5. Emergency Funds and Lines of Credit

Unexpected downturns or exciting opportunities can arise at any moment. Structuring your finances can include provisions for emergency funds or lines of credit. These options provide you with the flexibility to navigate unforeseen challenges or seize unexpected opportunities, all without disrupting your long-term financial plans.

6. Unlocking Equity in Your Assets

Your existing assets may hold untapped equity. We help you explore options to unlock this equity, which can be reinvested into your business or used for other financial goals. This can be a game-changer for businesses looking to expand or improve their financial position.

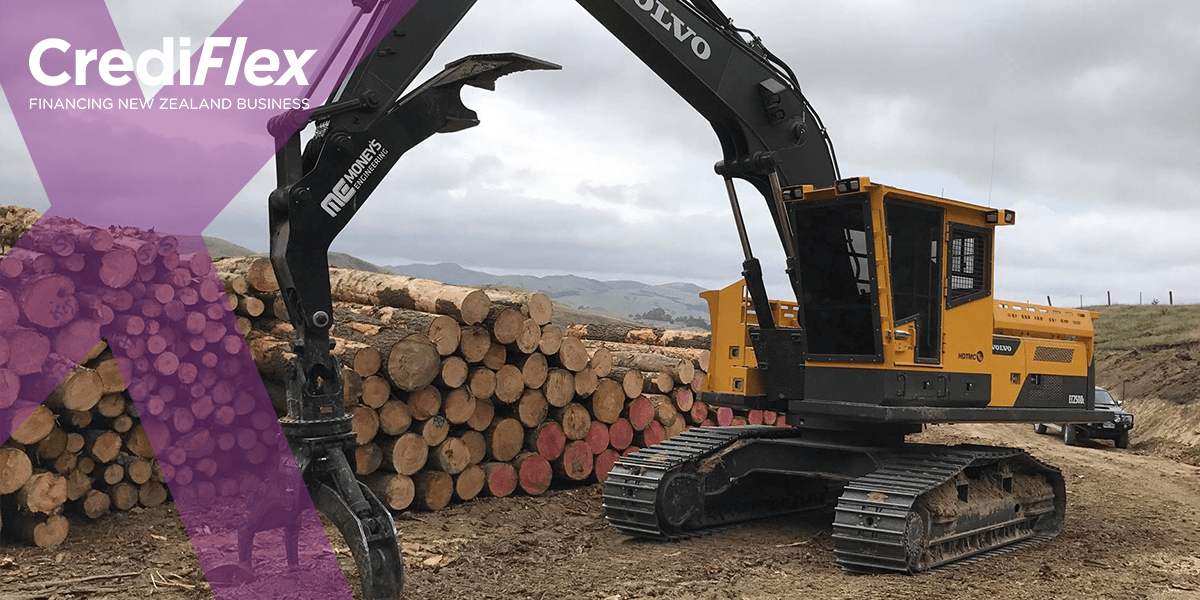

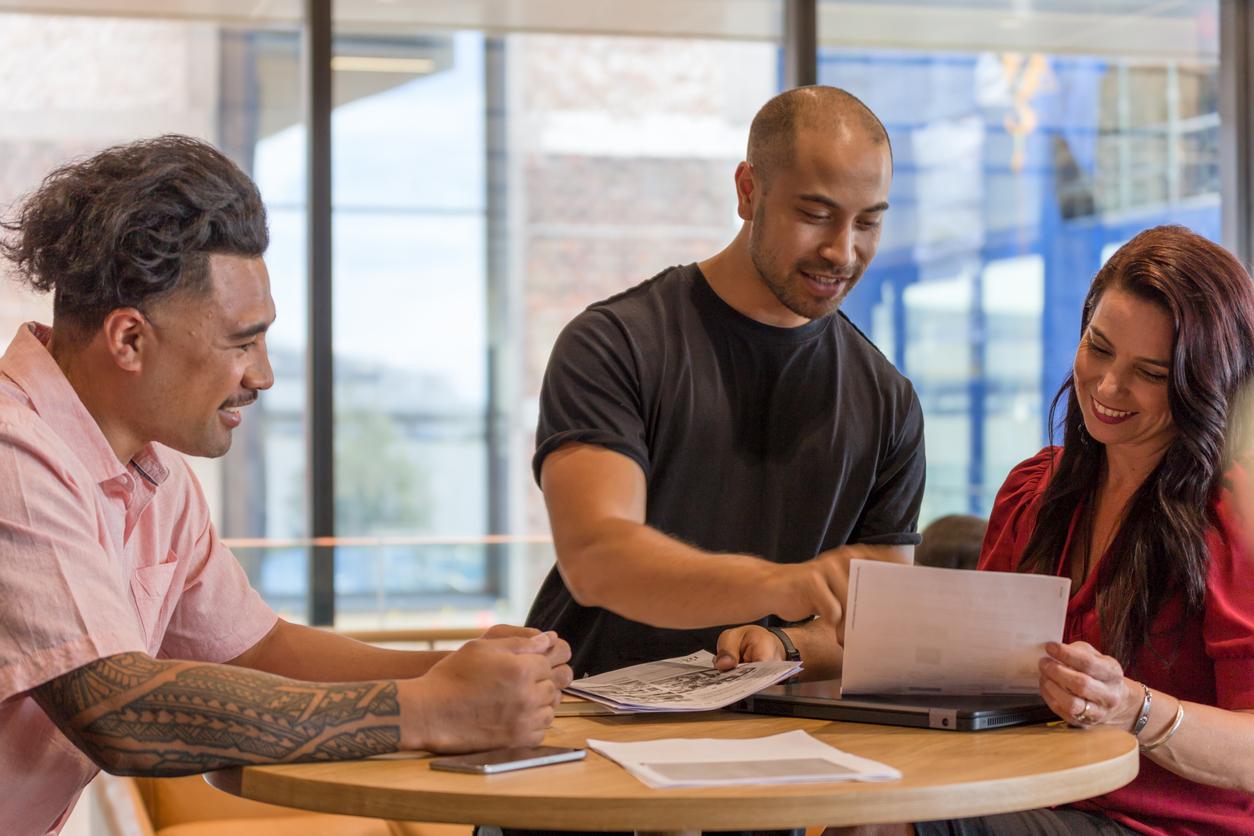

At CrediFlex, we understand that every client’s financial situation and business is unique. That’s why we take a personalised approach to help you structure your financing to align with your specific needs and objectives. Our financial partners specialise in asset and commercial finance and have a wealth of knowledge and experience in the agricultural, transport, construction, forestry, and earthmoving industries.

In conclusion, while securing favourable interest rates is undeniably important, the structure of your financing arrangements is equally, if not more, crucial. It directly impacts your cash flow, business stability, and long-term goals. By working closely with CrediFlex partners, you can ensure that your financing aligns perfectly with your unique business needs, setting you on a path to financial success. Don’t just focus on interest rates; focus on the bigger financial picture and watch your business thrive.

Contact us today to explore how we can help you structure your finances for a brighter future.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog.

This blog is for the use of persons in New Zealand only.

Copyright in this blog is owned by Crediflex. You must not reproduce or distribute content from this blog or any part of it without prior permission.