Applying for finance can be stressful, even at the best of times. If the loan is to help get you through a difficult trading period, the stress can be even greater!

But there’s a lot you can do to make the process not only easier for you, but also more likely to achieve your desired outcome. Welcome to the Crediflex Seven-Step Finance Application Stress Reduction Guide:

Step 1. Determine your financing needs.

This may sound like a no-brainer, but you’d be amazed how many people apply for finance by taking a guess at what they’ll need and how they’ll use the funds.

Don’t be like them. First, determine what it is you want the finance for (for example, the type of truck or machinery you want to finance), the amount of money you need to borrow, and your budget for monthly payments.

Step 2. Research lenders (also called Shop Around!):

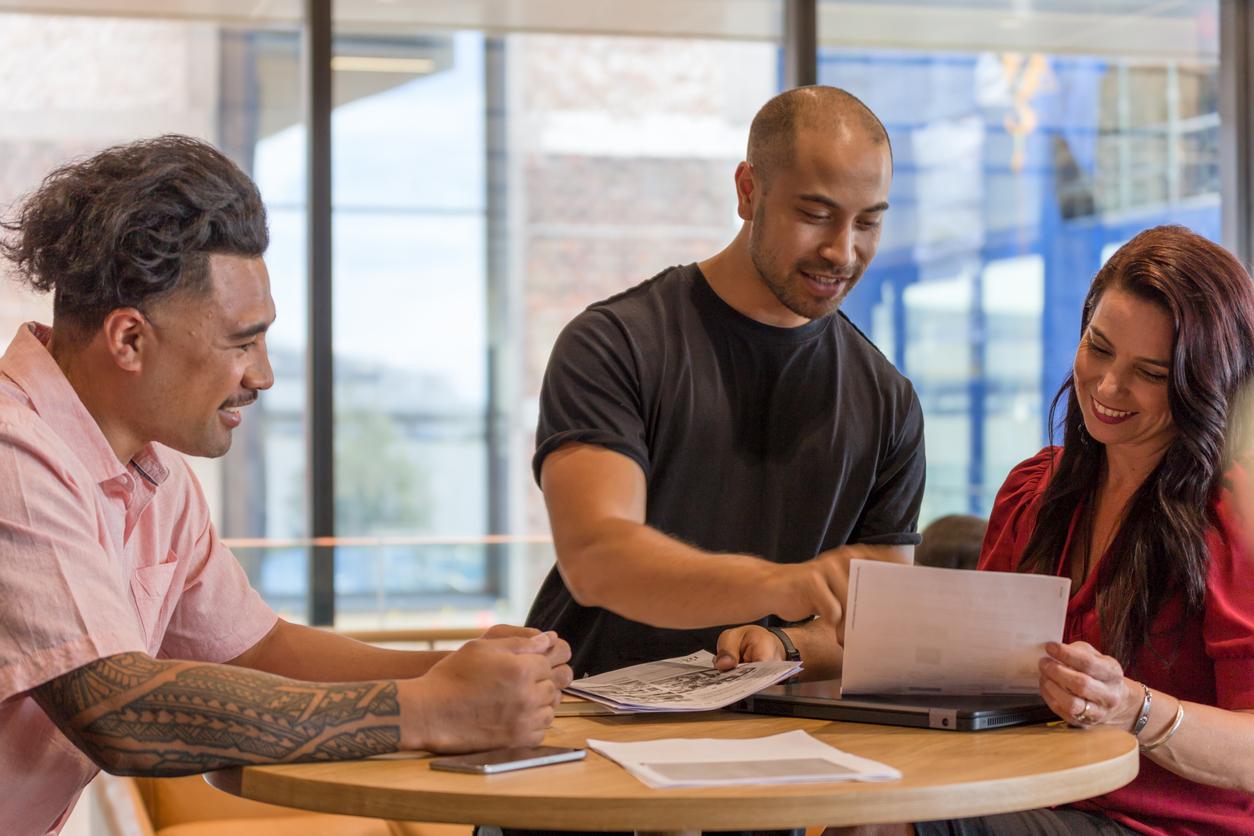

Different lenders offer different terms and rates for various types of lending. Once you know what you need to borrow and what it’s for, research different lenders for trucks or machinery. You can do much of that research online, but don’t overlook talking to your local banks, credit unions, or finance companies in person or by phone.

Step 3. Gather the documents you’ll need:

If you’ve prepared end-of-year records for your accountant, you’ll be familiar with this step. Before you can apply for finance, you’ll need similar documentation for the lender, including financial statements, tax returns, and credit reports. Gathering these now can avoid a stressful rush later.

Step 4. Complete the application:

Once you’ve completed Steps 1-3, you’re in good shape for completing the finance application. It will ask a series of personal and financial questions, as well as details about the truck or machinery you want to finance. Answering those questions will be fairly straightforward.

Step 5. Wait:

Once you submit your application, it’s time to wait for the lender to review it and make their decision. This may only take a few days, but it may also take a few weeks depending on the lender.

Step 6. Finalise the loan:

If your application is approved, congratulations! The lender will now forward you a loan agreement and any additional documentation they need you to sign. Read the documents carefully and be sure you understand them before signing. Ask the lender about anything you’re unclear about. It can also be a good practice to have your lawyer view any agreements before signing.

Step 7. Take delivery of the truck or machinery:

This is what the whole loan application was about. Now you have the equipment you need to run your business as you intend. Enjoy it and keep building a future for yourself and those close to you!

For more information on how to successfully apply for finance, you can talk to a Crediflex advisor in your area.

The information in this blog is for educational and informational purposes only and should not be considered as financial advice. Those wishing to make a purchase should always consult with a qualified financial advisor.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog.

This blog is for the use of persons in New Zealand only.

Copyright in this blog is owned by Crediflex You must not reproduce or distribute content from this blog or any part of it without prior permission.