Why Structuring Your Finances Matters More Than Chasing the Lowest...

Read MoreFrequently Asked Questions

100% New Zealand owned and operated, established 20 years ago by a group of finance experts with the desire to offer clients a choice of lending solutions without the constraints of a single provider.

At CrediFlex we pride ourselves on structuring flexible finance packages that suit our clients unique needs and with an extensive lender network that enables us to negotiate favorable terms on your behalf. Not being restricted to a single lender allows us to place your funding request with the most appropriate lender or a combination of lenders, that offers the risk appetite, products, structure, speed and price that matches your priorities.

We do the work and simplify the process for you, so that you can focus on your business.

Asset finance is a financing solution that allows businesses to acquire assets such as vehicles, equipment, or machinery without needing to pay the full amount upfront. This financial arrangement helps manage cash flow more effectively.

From commercial vehicles and manufacturing machinery to IT equipment, almost any tangible asset essential for your business operations can be financed with the help of CrediFlex.

Provided all the information is received to complete the application, a loan approval can be received in as little as one business day, but this varies depending on the lender and complexity of the finance request.

Generally only the assets being purchased together with the directors personal guarantees, however this is dependent on the risk profile. In some cases additional collateral or a deposit will be required.

The term of an asset finance agreement can vary, typically from one to 5 years, depending on the type of finance product and the asset’s economic life expectancy

Our interest rates vary depending on the amount borrowed, loan term, security, and overall risk profile, however the interest rates offered will be competitive.

It’s possible, but more challenging. CrediFlex understands that each business’ situation is unique. Offering a personalized approach, with access to multiple lenders to find a financing solution that works for you.

Every finance requirement is different, and information required would be depend on the request. Your CrediFlex partner will confirm what is required when they assess your finance needs. Generally the information required would be:

- Authority and Declaration form

- Personal Statement of Position

- Most recent financial statements

- Invoice/valuations

- NZ Passport or Drivers license

- Proof of address

You can repay your loan before the end of the term, however the lender may charge an early repayment fee. In addition the lender may require CrediFlex to refund some, or all, of the commission paid for arranging the loan or financial product. To fairly remunerate CrediFlex for services provided in arranging the loan or financial product, CrediFlex will seek reimbursement from the borrower (CrediFlex client) for any commission refund due to the lender. Please see the CrediFlex disclosure statement here.

Our Stories

Purchase Over Leasing

The Decision to Purchase versus Leasing an Asset Whether it’s...

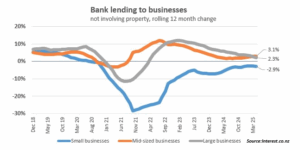

Read MoreA Shifting Landscape in Business Lending

Why Using a Finance Broker for Asset Finance Makes More...

Read MoreHow the New Investment Boost Supports Business Asset Purchases

How the New Investment Boost Supports Business Asset Purchases The...

Read MoreGrowing NZ Businesses with Flexible Financing Solutions

Growing NZ Businesses with Flexible Financing Solutions Securing the right...

Read MoreThe Power of a Pre-Approved Limit: Why Securing Asset Finance Early Gives Your Business an Edge

The Power of a Pre-Approved Limit: Why Securing Asset Finance...

Read MorePlanning for 2025 to Strengthen Cashflow with Asset Finance and Refinancing

Planning for 2025 to Strengthen Cashflow with Asset Finance and...

Read MoreBeyond the Loan

Beyond the Loan In the dynamic world of business finance,...

Read MoreDealer Finance vs. Broker Finance

Which is Right for You? When it comes to financing...

Read MoreFinancial Fitness for Your Business: 5 Key Metrics Every Business Owner Should Track

Running a successful business requires more than just a great...

Read MoreFinancial Flexibility: Financing Options for NZ Businesses

Financial flexibility is essential in today’s fast-paced business environment. Whether...

Read More“Survive until 25”

“Survive until 25” is a phrase being used more and...

Read More