Navigating the world of asset finance can be a daunting task, filled with technical jargon. To simplify this journey, team up with CrediFlex, a leader in providing bespoke financing solutions, to bring you answers to the frequently asked questions about asset finance.

1. What Is Asset Finance?

Asset finance is a financing solution that allows businesses to acquire assets such as vehicles, equipment, or machinery without needing to pay the full amount upfront. This financial arrangement helps manage cash flow more effectively.

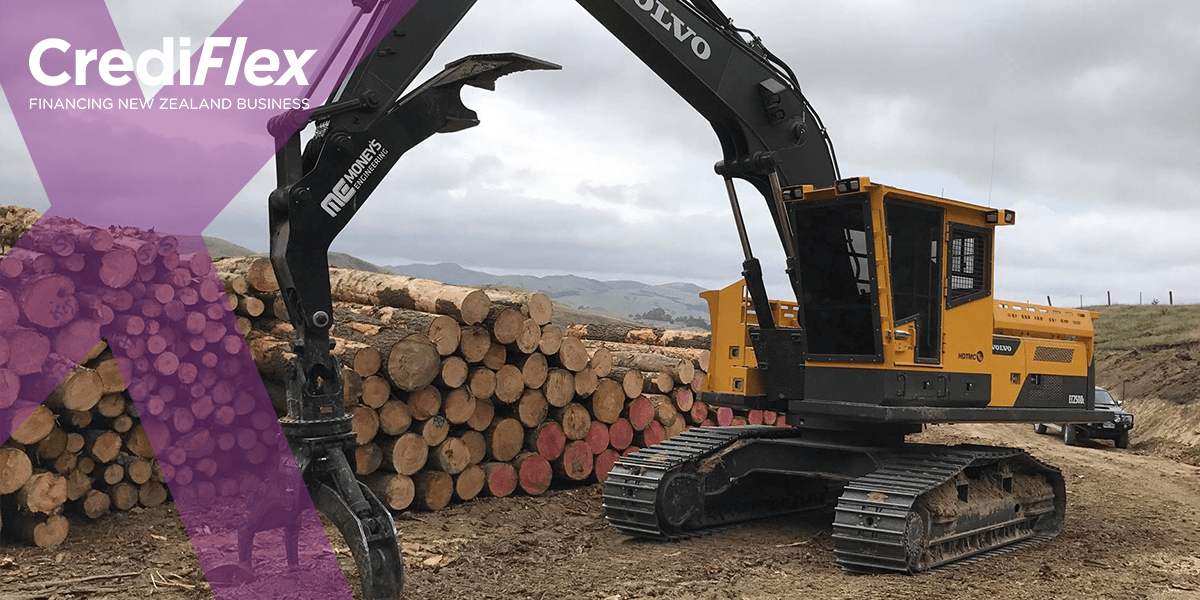

2. What Types of Assets Can Be Financed?

From commercial vehicles and manufacturing machinery to IT equipment, almost any tangible asset essential for your business operations can be financed with the help of CrediFlex.

3. What Are the Different Types of Asset Finance?

CrediFlex has a large network of lenders, from main banks to niche finance companies and offers various asset finance options including hire purchase, finance leases, and chattel mortgages, ensuring you find the right solution to fit your business needs.

4. How Does Asset Finance Differ from Traditional Loans?

Unlike traditional loans, asset finance is secured against the asset itself, which often results in better terms and competitive interest rates because the loan is less risky for lenders compared to unsecured facilities.

5. What Are the Benefits of Asset Finance?

Opting for asset finance through CrediFlex can improve your cash flow, allow access to the latest equipment, all while avoiding the full upfront cost of purchasing assets.

6. How Long Does an Asset Finance Agreement Last?

The term of an asset finance agreement can vary, typically from one to five years, depending on the type of finance product you choose and the asset’s life expectancy.

7. Can I Obtain Asset Finance with Bad Credit?

Its possible, but more challenging. CrediFlex understands that each business’s situation is unique. Offering a personalized approach, with access to multiple lenders to find a financing solution that works for you.

8. How Do I Apply for Asset Finance?

Applying for asset finance with CrediFlex is straightforward. Contact us on 0800 CREDIFLEX / 095233102 alternatively by visiting the website CrediFlex.co.nz and filling out a contact form, and one of the team will contact you directly for a personalized consultation

Asset finance can offer a strategic advantage for your business, providing the flexibility to grow and adapt in a fast-changing market. CrediFlex is here to guide you through the process, offering expert advice and tailored financial solutions. Whether you’re looking to expand your operations or upgrade your equipment, CrediFlex has the expertise to support your ambitions.

Visit CrediFlex.co.nz to learn more about how asset finance can work for your business, or contact their team directly to discuss your financing needs and kickstart your application process today. Let CrediFlex help you unlock the potential of your business with the right financing solution.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog. This blog is for the use of persons in New Zealand only. Copyright in this blog is owned by Crediflex.