Having a good credit history is key to more than just accessing finance like mortgages, car loans or credit cards. It’s what many providers consider when they supply goods or services with deferred payment. Even renting a home or getting a job can be out of reach for those with black marks on their credit history. Lenders and providers know that past behaviour equals future behaviour. They look at a person’s credit history to determine whether they are likely to repay debt or fulfil their contract. It only takes a few missed or late payments to establish a bad credit history which is hard to shake.

Anyone who is commercially active has a credit history. The secret to financial security is ensuring it’s a good credit history.

How does it work

Commercially active individuals develop a credit history simply by doing their personal business. A credit score is generated when they consume services such as utilities, rent a home or take out insurance. The providers feed information about their payment history to credit reporting bureaus like Centrix and Illion who compile credit reports on that individual. Future providers have the right to request the report to determine if individuals are financially responsible and choose to withhold services if they are not.

As soon as a provider requests an individual’s report from the bureau or supplies information about the individual the history begins. Over time as the individual makes transactions or acquires debts, they will generate a score. Credit scores range from zero to 1000. Those who want easy access to finance at the best rate should aim to have a minimum average score of 500-699.

How to Get a Credit History

The most obvious way to build a credit history is lending for mortgage finance, personal loans, vehicle finance or credit cards. Less obvious is the credit history you create through payment of everyday expenses such as utilities (phone, electricity, broadband), insurance and subscriptions. Many consumers, especially young people are unaware that small incidents are recorded on their credit history. Failing to pay a power bill, not returning a library book, and pulling out of a fixed-term phone contract all impact an individual’s credit score. Factors like changing a home address frequently also impact your score.

If you make payments in full and on time your credit history is good, if you miss or delay payments your credit history is bad.

There are four things you must do to establish a good credit history – pay bills on time, pay off all loans and debts fully, honour all contractual obligations and have stable behaviours. The complexity is in choosing the type of debt that is safe for you.

It’s Never Too Early to Start Building Your Credit

It doesn’t take long to build a credit history. However, the longer your credit history the more predictable your future behaviour. Lenders use this prediction to evaluate credit applications. A good history will lead to fast approval at the best interest rate. Bad history may prevent you from accessing finance or opening accounts.

If you have built a consistently good payment record over a long period of time you are perceived as a low credit risk which gives you easier access to affordable finance. So even if you have no short-term financial goals it’s important to focus on building a good credit history.

Here are tips for young people with no existing credit history.

Take a Student Bank loan

Student Bank loans with a 0% interest overdraft are a good way for young people to build a credit history. They are cheap with a relatively low risk of overspending. Even if you never draw down the funds you will be creating history as a good borrower.

Have a Stable address

Lenders look for stability in people that don’t move constantly. If you’re flatting, it’s advisable to use your parents’ address for financial accounts.

Don’t underestimate the harm caused by minor incidents of missing or delaying everyday expenses like power and phone accounts. They may not seem like a huge deal when you’re young and transient, but once accrued they become a permanent record on your credit history.

Avoid getting Tarnished by Flatmates Credit History

If you’re the named holder of a shared account, make sure your flatmates are making regular payments to cover the invoices. Many young people have earned black marks when their mates have moved on without paying their share of the utility accounts.

The Safe Easy Path to a Good Credit History

Start small with the basics. Open utility or subscription accounts in your own name and stay focused on paying all invoices in full on time.

Borrowing and Budgeting go hand in hand.

It’s important to spend time creating a budget before you take on debt and stick to the plan when you spend the funds.

Choose the type of credit wisely.

A small overdraft is less likely to become an issue than a credit card. But more importantly, only use borrowed funds to buy goods and services that you have budgeted within your means.

Choose a bank and stick to it.

Spend the time to research banks and accounts and choose one that best suits your specific needs. Then stay with these for a long period. This shows you are stable and have longevity which are both indicators of a good borrower.

Be careful with Buy Now Pay Later schemes (BNPL)

Do your homework before you join a Buy Now Pay Later schemes like Afterpay or Laybuy. BNPL providers work closely with credit agencies, so your every move instantly becomes part of your credit history. For instance, if you miss or delay just a $10 payment on a BNPL app your credit history will be affected. Conversely, the app also reports payments paid on time which generates a good credit score. It’s important to have eyes open and manage BNPL accounts carefully.

Credit Cards may not suit you

Banks encourage Credit Cards because they are a good earner for them. They are easy to acquire because they are a good way for banks to acquire new customers and their high-earning products. They are also a quick way for individuals to build a credit history with reputable lenders. However, Credit Cards introduce spending creep. It’s easy to pull out a Credit Card to make an impulse purchase without seeing the wealth reduction effect of that purchase. Some experts say there is at least a 20 per cent ‘easy creep’ factor to frequent spending. That means you could be spending $200 in every $1000 more than you can afford. It’s important for cardholders to restrict credit card spending to budgeted purchases and pay them off in full on every due date. If you are tempted to use your credit card for unbudgeted purchases, you could build debt that you are unable to repay and subsequently erode your credit score.

Consider a Debit Card

If credit cards are an unmanageable temptation for you, consider using a debit card. You will still create a payment history, but you will only be spending the money you have.

Build credit history now

Stay focused on consistent good credit behaviour regardless of whether you have an immediate need for credit. All history counts for something but the longer you have good credit history the higher and more consistent your credit score. Remember that just one incident of bad behaviour makes a huge dent in your credit history which could take years to repair.

Check Your Credit History Regularly

Credit reference agencies provide free reports usually within about ten days. It’s advisable to use this service to keep an eye on your own credit history so that you can better manage it.

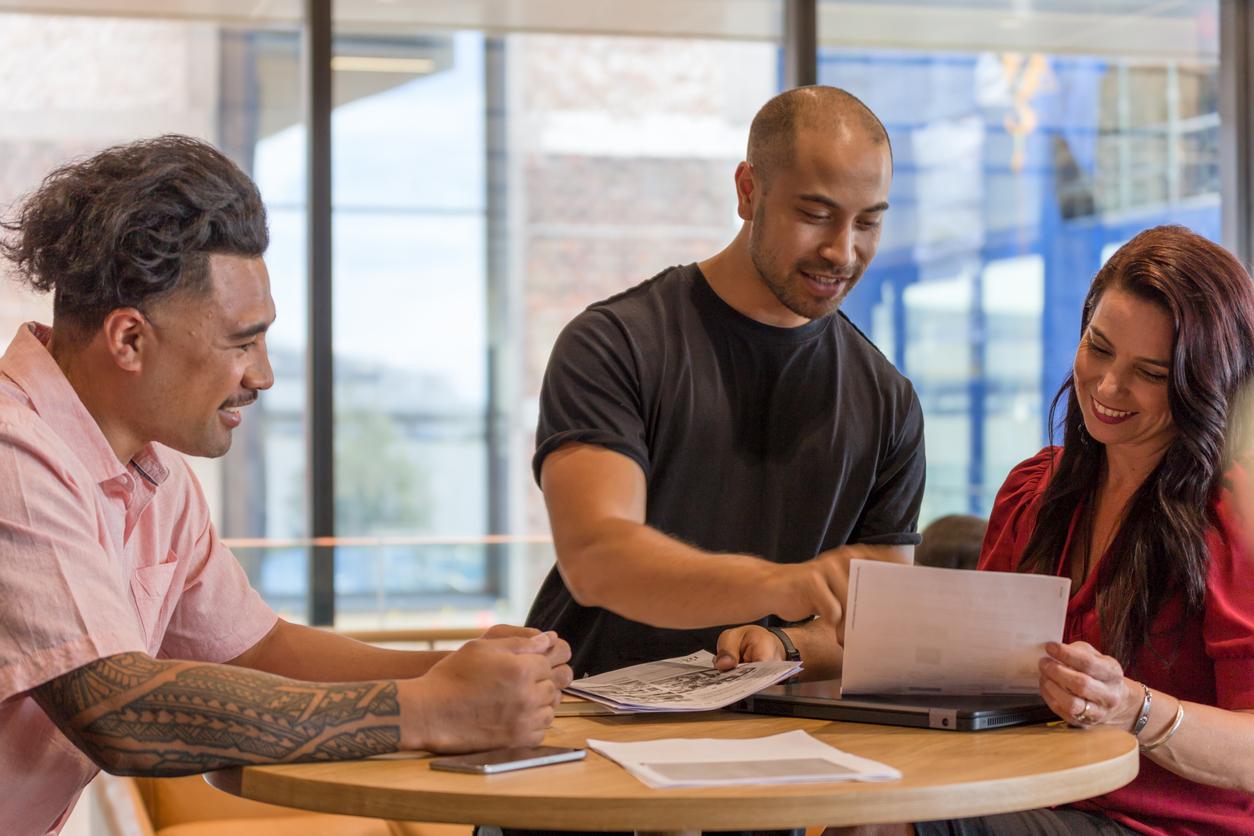

For more information on building a credit history, you can talk to a Crediflex advisor in your area.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog.

This blog is for the use of persons in New Zealand only.

Copyright in this blog is owned by Crediflex You must not reproduce or distribute content from this blog or any part of it without prior permission.

09 523 3102

0800 CREDIFLEX

0800 273 343 539