How the New Investment Boost Supports Business Asset Purchases

How the New Investment Boost Supports Business Asset Purchases The New Zealand Government’s new Investment Boost—introduced on 22 May 2025—offers a valuable incentive for businesses to invest in new productive assets such as machinery, tools, vehicles, and commercial buildings. If your business is planning capital investment, this tax initiative can reduce your taxable income and […]

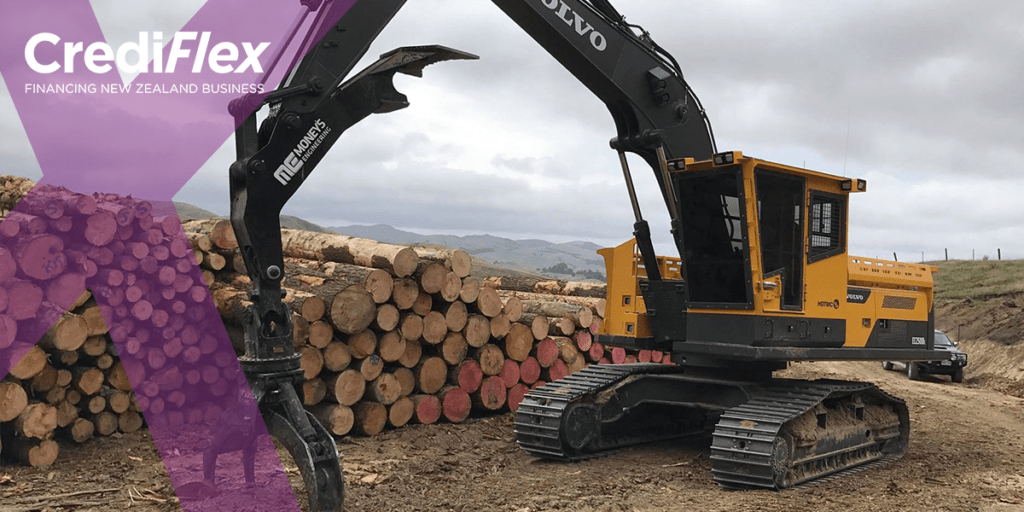

Growing NZ Businesses with Flexible Financing Solutions

Growing NZ Businesses with Flexible Financing Solutions Securing the right funding is critical for business growth, but navigating finance options can be complex. At CrediFlex, our finance brokers simplify the process, helping businesses across New Zealand access lending solutions. Whether you need funding for equipment, working capital or expansion, we connect you with the lenders […]

The Power of a Pre-Approved Limit: Why Securing Asset Finance Early Gives Your Business an Edge

The Power of a Pre-Approved Limit: Why Securing Asset Finance Early Gives Your Business an Edge In today’s fast-moving business environment, having access to the right assets at the right time can be the difference between growth and missed opportunities. Yet, many businesses delay securing finance until they absolutely need it, which can lead to […]

Planning for 2025 to Strengthen Cashflow with Asset Finance and Refinancing

Planning for 2025 to Strengthen Cashflow with Asset Finance and Refinancing Businesses across New Zealand are looking towards 2025 with renewed optimism. The economy is forecast to improve with inflation under control and interest rates on a downward trajectory, presenting an excellent opportunity to strengthen your business’ financial position. One of the most critical factors […]

Beyond the Loan

Beyond the Loan In the dynamic world of business finance, securing a loan is just the beginning. Companies need more than just capital; they need a partner who understands their unique challenges and can provide comprehensive support. This is where we at Crediflex stand out. As a leading commercial finance broker in New Zealand, we […]

Dealer Finance vs. Broker Finance

Which is Right for You? When it comes to financing your business assets, you’ve got options. Should you go with dealer finance or work with a finance broker? Here’s a quick guide to help you decide which route is best for your business. Dealer Finance: Convenience at a Cost Dealer finance is straightforward. When you’re […]

Financial Fitness for Your Business: 5 Key Metrics Every Business Owner Should Track

Running a successful business requires more than just a great product or service; it demands a keen understanding of your financial health. Just like personal fitness, financial fitness for your business involves regular monitoring and assessment of key metrics to ensure sustained growth and stability. Here are five essential financial metrics every business owner should […]

Financial Flexibility: Financing Options for NZ Businesses

Financial flexibility is essential in today’s fast-paced business environment. Whether you’re looking to stabilise your cash flow, invest in new opportunities, or manage seasonal fluctuations, having the right financial tools at your disposal can make all the difference. At Crediflex, we offer a range of financing options designed to meet the diverse needs of New […]

“Survive until 25”

“Survive until 25” is a phrase being used more and more as we navigate the tough trading conditions of 2024. But what does it mean and what concrete steps can you take to give you and your business the best chance of surviving – and thriving – in tough economic conditions. The answer is liquidity […]

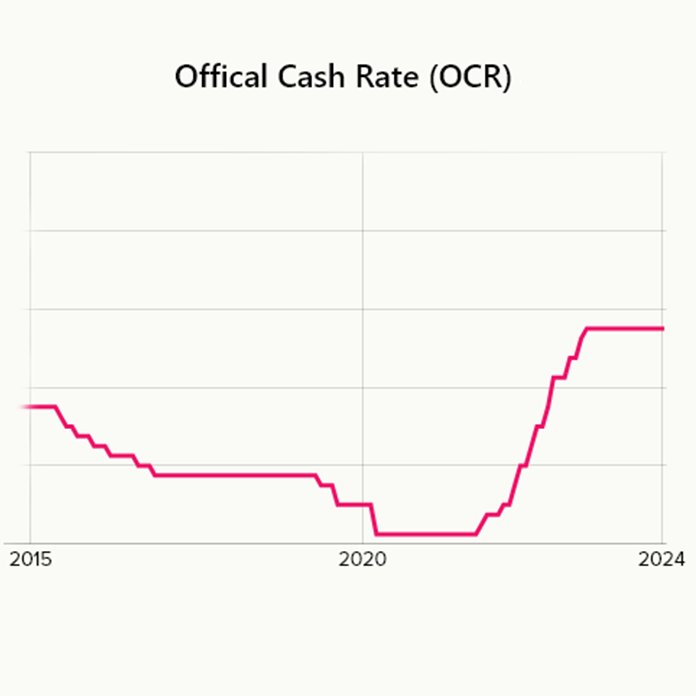

Economic Update: OCR Cuts with More Reductions on the Horizon

The New Zealand economy is beginning to see a glimmer of hope as inflation and interest rates ease. The Reserve Bank of New Zealand (RBNZ) recently cut the Official Cash Rate (OCR) by 25 basis points to 5.25%, marking the first reduction since March 2020. This move signals a shift in monetary policy, with further […]