As a business owner, navigating the world of finance can be a daunting task. Whether you’re looking to manage cash flow, secure funding, or finance a new asset, having a trusted advisor by your side can make all the difference. At CrediFlex, we understand the challenges and aspirations that come with running a business. Our team of experienced brokers is here to offer tailored financial solutions and expert guidance to help you achieve your goals. In this month’s blog, we delve into the valuable role CrediFlex brokers play in assisting New Zealand business owners and consumers looking to finance an asset.

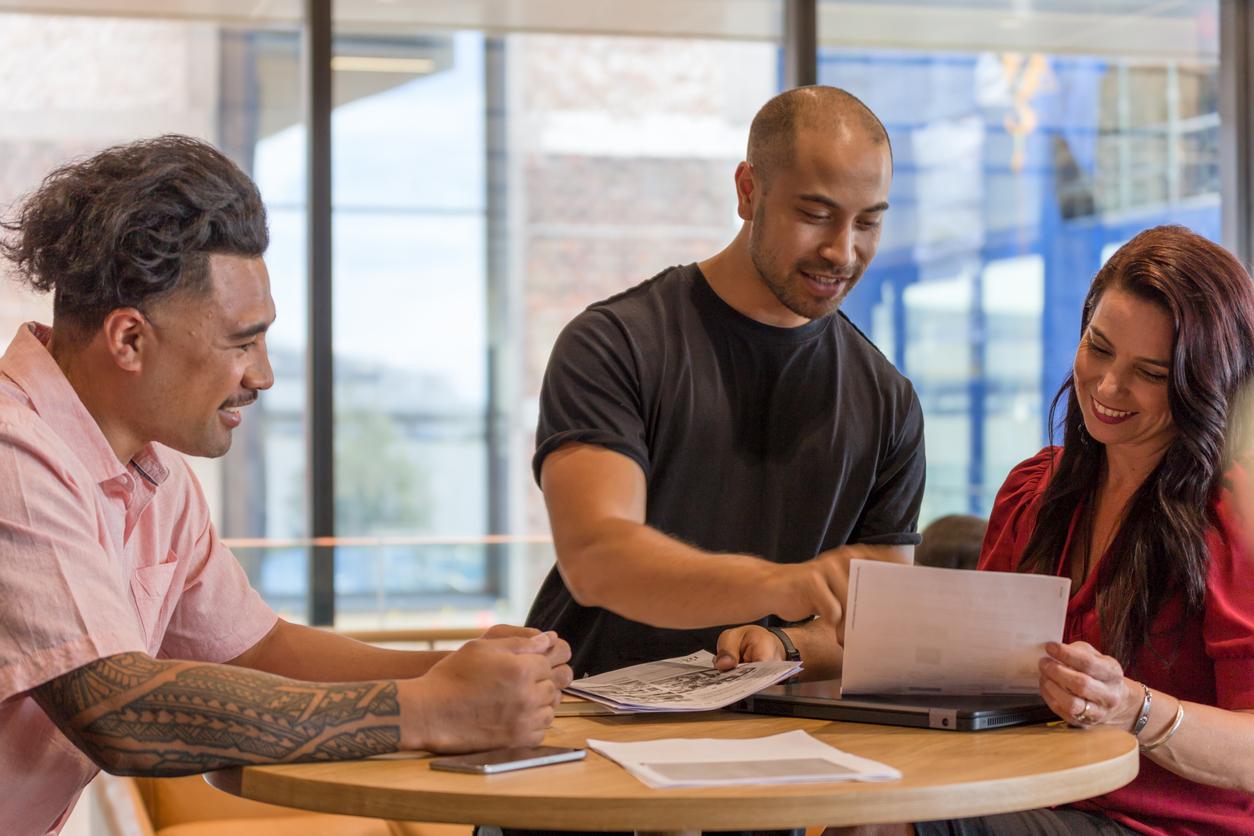

1. Understanding Your Business and Providing Tailored Solutions:

At CrediFlex, we recognise that each business is unique, with its own set of requirements and financial circumstances. Our dedicated brokers have a deep understanding of various industries and the challenges they face. By taking the time to understand your business operations, goals, and risk tolerance, our brokers can offer personalised financial solutions that align with your specific needs. Whether you need help with cash flow management or require financing for expansion, our brokers are equipped to provide the right guidance.

2. Industry Expertise and Specialised Advice:

Our brokers possess a wealth of industry knowledge and expertise. They stay updated on market trends and financial products to provide you with the most relevant and up-to-date advice. Whether you’re a seasoned entrepreneur or starting a new venture, our brokers can offer specialised advice tailored to your industry. Their insights can help you make informed decisions, minimise risks, and seize opportunities for growth.

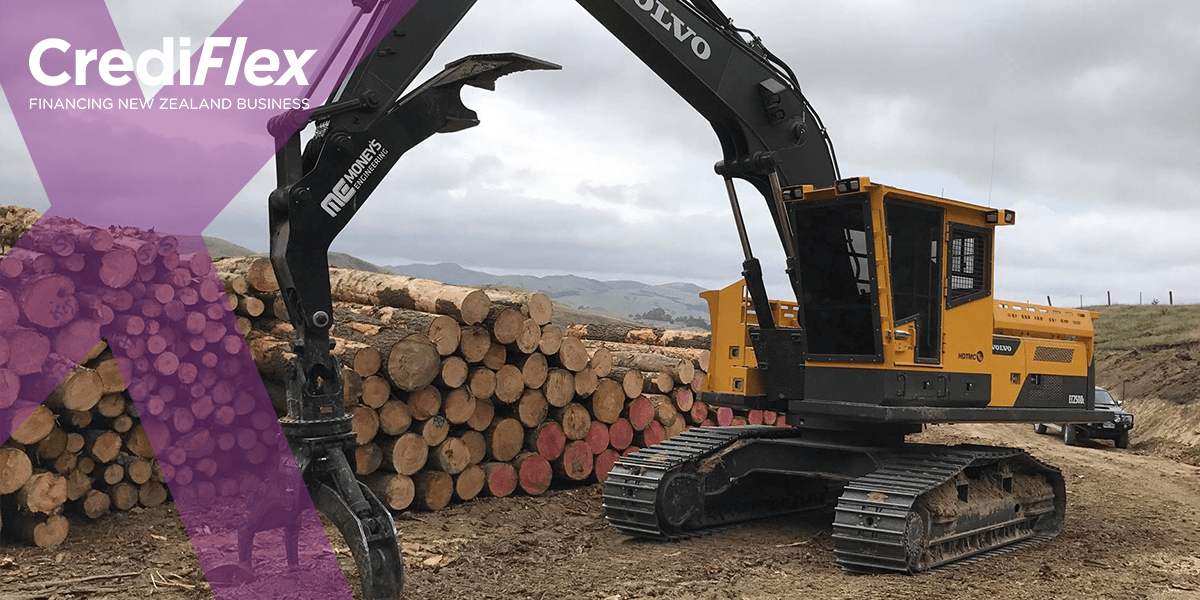

3. Access to a Wide Network of Lenders:

One of the key advantages of working with CrediFlex brokers is their extensive network of lenders. These strong relationships allow our brokers to expand your funding options and negotiate favourable loan terms on your behalf. By leveraging their connections, our brokers

can help you secure the financing you need, whether it’s for purchasing new equipment, expanding your operations, or meeting short-term cash flow requirements.

4. Simplifying Complex Financial Processes:

Financing can often involve complex procedures and paperwork. CrediFlex brokers are here to simplify the process for you. They guide you through each step, ensuring you have a clear understanding of the terms and conditions. Our brokers handle the paperwork, allowing you to focus on your core business activities while having the peace of mind that your financial needs are being taken care of efficiently and effectively.

5. Ongoing Support and Building Long-Term Relationships:

CrediFlex is committed to being more than just a one-time solution provider. Our brokers aim to build long-term relationships with business owners, acting as trusted advisors throughout their financing journey. Whether you need assistance with refinancing, reviewing loan structures, or exploring new funding opportunities, our brokers are here to provide ongoing support and guidance. We strive to be your partner in success.

6. Prioritising Favourable Loan Terms and Competitive Rates:

At CrediFlex, we understand the significance of favourable loan terms and competitive rates for your business’s financial health. Our brokers work tirelessly to negotiate the best possible terms for you, ensuring that you receive financing that aligns with your goals and financial capabilities. We prioritise your best interests and aim to secure financing solutions that provide optimal value for your business.

When it comes to financing your business, having a knowledgeable and experienced advisor can make all the difference. CrediFlex brokers are here to support New Zealand business owners and consumers looking to finance an asset. With their deep industry expertise, personalised solutions, and strong lender connections, they are dedicated to helping you achieve your financial goals. Trust CrediFlex as your partner in success, and let our brokers guide you on the path to a prosperous future for your business.

While every care has been taken to supply accurate information, errors and omissions may occur. The information in this blog provides general information and is not intended to be financial advice. You should consult a professional financial adviser before making any financial decision. You are solely responsible for any loss suffered from relying on information in this blog.

This blog is for the use of persons in New Zealand only.

Copyright in this blog is owned by Crediflex You must not reproduce or distribute content from this blog or any part of it without prior permission.